ESG Strategy & Reporting

Because investors are not only concerned about the future on Fridays.

The increasing importance of ESG in private equity is being driven particularly by the sharp rise in demand on the part of investors. Sustainability, social responsibility and good corporate governance are now no longer niche topics but fundamental elements of each private equity value creation programme. To offer investors satisfactory solutions, fund managers have to develop ESG strategies that are effective, efficient and economical while ensuring maximum possible transparency.

Why is there no way around ESG any longer?

Global pressure on the part of investors is driving demand for sustainable investment options

In recent years, investors' increased awareness of sustainability, ethical standards, social responsibility and good corporate governance has led to unprecedented demand for ESG-oriented investment options. Since around 2005, the volume of assets managed in private equity funds committed to ESG has increased more than tenfold. During the same period, the number of UNPRI signatories surpassed the 3,000 mark.

Increased expectations of workers, customers and society and their willingness to share responsibility

The megatrend of ESG is being driven by a growing awareness of environmental risks, social and demographic changes and political challenges of the future, as well as people's willingness to take part in resolving them.

A company that is unable to offer a clear approach to the challenge of ESG will not only be exposed to risks but will also miss out on opportunities to access new markets, be innovative and grow.

Sustainable investments perform better in the long term

Although financial performance is not always the primary motivation of an impact investor, the positive influence of sustainability on economic success has already been demonstrated multiple times. In addition, the ESG factor not only offers a premium compared to classic investments but also significant protection by limiting the downside risk in a crisis.

How do you successfully master the challenge of ESG?

Disclosing the ESG KPIs in the fund's annual report is not sufficient to achieve an effect on its own. The collection of KPIs and the acquisition of accreditations solely for reporting and marketing purposes typically lead to what is called greenwashing - a frequent mistake and misunderstanding.

ESG necessitates long-term commitment in the context of value creation. A foundation consisting of clearly defined values and principles is required to establish a strong ESG strategy for the fund.

Depending on the desired level of engagement and strategic orientation of the fund we support the fund management in elaborating a clear framework to integrate ESG in the portfolio management and reporting structures.

How can we help?

The complexity of the challenge of ESG is due, firstly, to its extensive sphere of influence - essentially, each area of the organisation, all stakeholders and externals are affected by the goals of a fund's ESG strategy. This necessitates a strong commitment to the defined principles, corresponding incentive models for decision-makers and effective public communication. Secondly, it involves the details - the establishment of a KPI system appropriate to the goals, the monitoring of the right areas of a business and the definition of reasonable goals that are to be achieved. Ultimately, the disclosure of figures alone does not yet lead to increased performance. Measures have to be put in place to implement the fund's ESG strategy, achieve an effect and realise the value, the ESG premium.

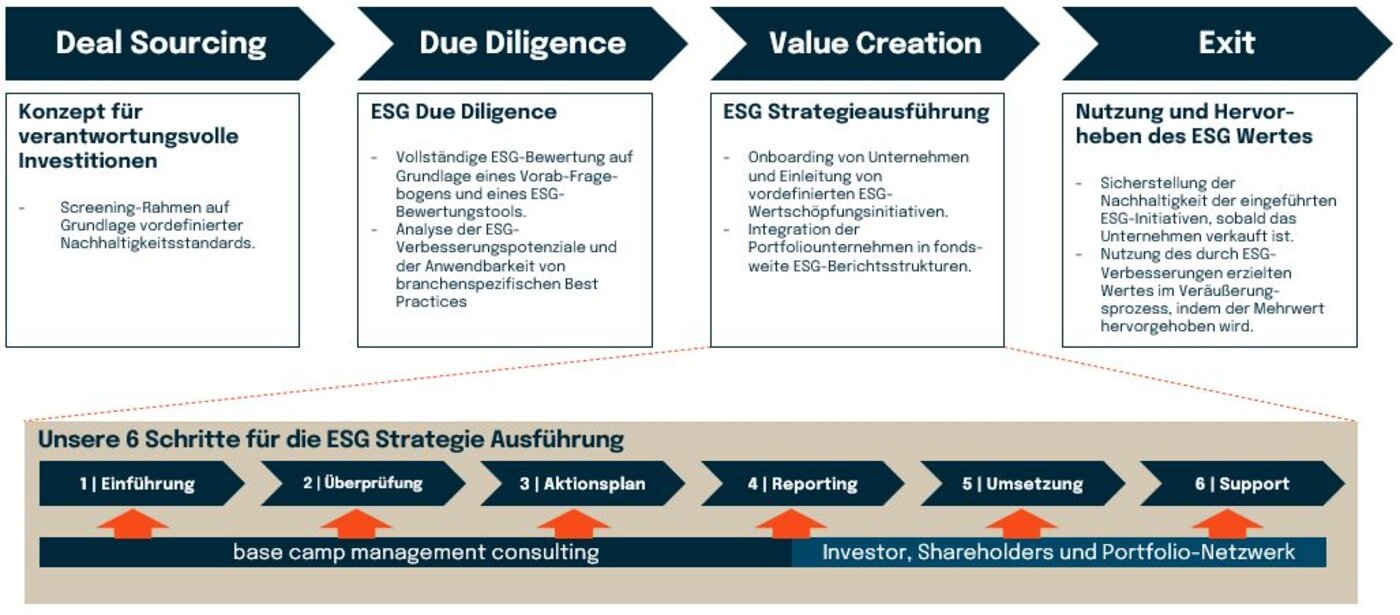

base camp is experienced in cooperating with private equity funds. We will help your PE fund to integrate ESG throughout the entire life cycle of its investments.

Our engagement begins already during deal sourcing by defining a principles-driven screening framework and sustainability standards. Typically, we support a portfolio company on its ESG journey until the final sale to ensure that the value of ESG improvements is also maximised in the exit process.

Define the right ESG strategy for your fund together with us in order to achieve the following:

- A clear ESG strategy and a principle-based framework for the entire fund that is based on international standards in order to benchmark your ESG performance against the industry

- Successful implementation of the fund's ESG strategy to maximise your investments' value creation

- Full transparency regarding ESG KPIs that are genuinely important and satisfy your investors' need for information

Contact us right now to find out more about what we have to offer!